- http://www.bohemiancoding.com/sketch --%3E %3Ctitle%3EPage 1%3C/title%3E %3Cdesc%3ECreated with Sketch.%3C/desc%3E %3Cdefs%3E %3Cpolygon id='path-1' points='57.0106786 0.000357142857 0 0.000357142857 0 34.7572143 57.0106786 34.7572143 57.0106786 0.000357142857'%3E%3C/polygon%3E %3C/defs%3E %3Cg id='Symbols' stroke='none' stroke-width='1' fill='none' fill-rule='evenodd'%3E %3Cg id='CR-StackedLogo'%3E %3Cg id='Page-1'%3E %3Cg id='Group-3' transform='translate(0.000000, 0.178214)'%3E %3Cmask id='mask-2' fill='white'%3E %3Cuse xlink:href='%23path-1'%3E%3C/use%3E %3C/mask%3E %3Cg id='Clip-2'%3E%3C/g%3E %3Cpath d='M38.1360357,15.9306071 L38.1360357,8.06203571 L42.86675,8.06203571 C45.03925,8.06203571 46.8249643,9.84828571 46.8249643,12.02025 C46.8249643,14.19275 45.03925,15.9306071 42.86675,15.9306071 L38.1360357,15.9306071 Z M23.5572857,23.5095357 C21.9646071,25.1023929 19.7921071,26.06775 17.3785357,26.06775 C12.59925,26.06775 8.68942857,22.1579286 8.68942857,17.3788214 C8.68942857,12.5995357 12.59925,8.68971429 17.3785357,8.68971429 C19.7921071,8.68971429 21.9646071,9.65525 23.5572857,11.2479286 L29.4469286,5.35882143 L29.4469286,29.3988214 L23.5572857,23.5095357 Z M29.4469286,34.2745357 L38.1360357,34.2745357 L38.1360357,23.5095357 L40.6946071,23.5095357 L46.9701429,34.2745357 L57.0106786,34.2745357 L49.3837143,21.8682857 C53.00425,19.9854286 55.5144286,16.22025 55.5144286,11.8272143 C55.5144286,5.55185714 50.3976429,0.483107143 44.1703214,0.483107143 L29.4469286,0.483107143 L29.4469286,4.87596429 C26.2605,1.88310714 22.0610357,0.00025 17.3785357,0.00025 C7.8205,0.00025 -3.57142858e-05,7.72435714 -3.57142858e-05,17.3788214 C-3.57142858e-05,27.0332857 7.8205,34.7572143 17.3785357,34.7572143 C22.0610357,34.7572143 26.2605,32.8743571 29.4469286,29.8815 L29.4469286,34.2745357 Z' id='Fill-1' fill='%2300AE4D' mask='url(%23mask-2)'%3E%3C/path%3E %3C/g%3E %3Cpath d='M150.731214,16.1079821 L150.731214,9.87226786 C150.973536,7.53655357 152.934607,6.39083929 154.917643,6.655125 L154.917643,5.46530357 C153.154964,5.20083929 151.524429,6.08226786 150.731214,7.62476786 L150.70925,5.531375 L149.585321,5.531375 L149.585321,16.1079821 L150.731214,16.1079821 Z' id='Fill-4' fill='%23000000'%3E%3C/path%3E %3Cpath d='M139.119518,10.0484821 C139.427911,7.91116071 141.036482,6.47883929 142.975589,6.47883929 C144.914518,6.47883929 146.523089,7.91116071 146.655232,10.0484821 L139.119518,10.0484821 Z M147.845054,10.3570536 C147.845054,7.404375 145.685768,5.42116071 142.997554,5.42116071 C140.243268,5.42116071 137.929696,7.60258929 137.929696,10.775625 C137.929696,13.9045536 140.353446,16.218125 143.195946,16.218125 C144.892554,16.218125 146.346839,15.513125 147.360411,14.2129464 L146.545054,13.5299107 C145.773804,14.5875893 144.606125,15.1384821 143.195946,15.1384821 C141.014518,15.1384821 139.251661,13.441875 139.097554,11.1061607 L147.845054,11.1061607 L147.845054,10.3570536 Z' id='Fill-6' fill='%23000000'%3E%3C/path%3E %3Cpath d='M121.602196,10.7315536 C121.646304,7.93316071 123.056482,6.478875 125.017554,6.478875 C126.670054,6.478875 127.771839,7.53655357 127.749696,9.43155357 L127.749696,16.1079821 L128.895589,16.1079821 L128.895589,10.7315536 C128.939696,7.93316071 130.349875,6.478875 132.310946,6.478875 C133.963446,6.478875 135.065232,7.53655357 135.043089,9.43155357 L135.043089,16.1079821 L136.188982,16.1079821 L136.188982,9.38744643 C136.210946,6.91958929 134.822732,5.42119643 132.443089,5.42119643 C130.746482,5.42119643 129.314161,6.43476786 128.697196,7.93316071 C128.234518,6.36869643 126.956482,5.42119643 125.149696,5.42119643 C123.585232,5.42119643 122.219161,6.32458929 121.602196,7.64673214 L121.602196,5.531375 L120.456482,5.531375 L120.456482,16.1079821 L121.602196,16.1079821 L121.602196,10.7315536 Z' id='Fill-8' fill='%23000000'%3E%3C/path%3E %3Cpath d='M117.151679,16.1079821 L118.297393,16.1079821 L118.297393,5.531375 L117.151679,5.531375 L117.151679,10.9078036 C117.107571,13.7061964 115.56525,15.1604821 113.427929,15.1604821 C111.731321,15.1604821 110.607393,14.1028036 110.607393,12.2078036 L110.607393,5.531375 L109.461679,5.531375 L109.461679,12.2519107 C109.461679,14.7197679 110.871857,16.2181607 113.295607,16.2181607 C115.036321,16.2181607 116.51275,15.2706607 117.151679,13.8824464 L117.151679,16.1079821 Z' id='Fill-10' fill='%23000000'%3E%3C/path%3E %3Cpath d='M100.802179,13.8604643 L100.16325,14.7638571 C101.154679,15.6452857 102.454679,16.2181429 104.151464,16.2181429 C106.1345,16.2181429 107.720929,15.1385 107.720929,13.2435 C107.720929,11.7451071 106.993786,11.1061786 104.636107,10.2908214 L103.732714,9.98242857 C102.41075,9.54171429 101.705571,9.101 101.705571,8.13153571 C101.705571,6.91957143 102.829321,6.45689286 103.864857,6.45689286 C104.856464,6.45689286 105.914143,6.98564286 106.685393,7.66885714 L107.368429,6.72135714 C106.376821,5.92796429 105.297179,5.44332143 103.864857,5.44332143 C102.058071,5.44332143 100.581821,6.41278571 100.581821,8.19760714 C100.581821,9.56367857 101.397179,10.4231429 103.402179,11.1281429 L104.41575,11.4808214 C105.914143,12.0095714 106.597179,12.296 106.597179,13.2435 C106.597179,14.6095714 105.407357,15.2045714 104.151464,15.2045714 C102.829321,15.2045714 101.661464,14.6536786 100.802179,13.8604643' id='Fill-12' fill='%23000000'%3E%3C/path%3E %3Cpath d='M90.8646964,10.7315536 C90.9088036,7.93316071 92.451125,6.478875 94.5884464,6.478875 C96.2852321,6.478875 97.4089821,7.53655357 97.4089821,9.43155357 L97.4089821,16.1079821 L98.5546964,16.1079821 L98.5546964,9.38744643 C98.5546964,6.91958929 97.1445179,5.42119643 94.7207679,5.42119643 C92.9800536,5.42119643 91.503625,6.36869643 90.8646964,7.75691071 L90.8646964,5.531375 L89.7189821,5.531375 L89.7189821,16.1079821 L90.8646964,16.1079821 L90.8646964,10.7315536 Z' id='Fill-14' fill='%23000000'%3E%3C/path%3E %3Cpath d='M82.5802143,15.0723571 C80.2445,15.0723571 78.3496786,13.1553929 78.3496786,10.8196786 C78.3496786,8.48396429 80.2445,6.567 82.5802143,6.567 C84.9378929,6.567 86.8328929,8.48396429 86.8328929,10.8196786 C86.8328929,13.1553929 84.9378929,15.0723571 82.5802143,15.0723571 M82.5802143,5.42128571 C79.6055714,5.42128571 77.2037857,7.84503571 77.2037857,10.8196786 C77.2037857,13.7943214 79.6055714,16.2180714 82.5802143,16.2180714 C85.5548571,16.2180714 87.9786071,13.7943214 87.9786071,10.8196786 C87.9786071,7.84503571 85.5548571,5.42128571 82.5802143,5.42128571' id='Fill-16' fill='%23000000'%3E%3C/path%3E %3Cpath d='M75.0224107,12.4282143 C73.8104464,13.9926786 71.915625,14.9621429 69.8002679,14.9621429 C66.1866964,14.9621429 63.2120536,12.0096429 63.2120536,8.37392857 C63.2120536,4.76017857 66.1866964,1.8075 69.8002679,1.8075 C71.9375893,1.8075 73.8104464,2.77714286 75.0224107,4.36357143 L75.9477679,3.46017857 C74.4934821,1.6975 72.268125,0.551607143 69.8002679,0.551607143 C65.4815179,0.551607143 61.9559821,4.07714286 61.9559821,8.37392857 C61.9559821,12.6926786 65.4815179,16.2182143 69.8002679,16.2182143 C72.268125,16.2182143 74.4715179,15.0723214 75.9038393,13.2875 L75.0224107,12.4282143 Z' id='Fill-18' fill='%23000000'%3E%3C/path%3E %3Cpath d='M124.092304,32.2054107 L123.453375,33.1088036 C124.444804,33.9902321 125.744804,34.5630893 127.441589,34.5630893 C129.424625,34.5630893 131.011054,33.4834464 131.011054,31.5884464 C131.011054,30.0900536 130.283911,29.451125 127.926232,28.6357679 L127.022839,28.327375 C125.700875,27.8866607 124.995696,27.4459464 124.995696,26.4764821 C124.995696,25.2645179 126.119446,24.8018393 127.155161,24.8018393 C128.146589,24.8018393 129.204268,25.3305893 129.975518,26.0138036 L130.658554,25.0663036 C129.666946,24.2729107 128.587304,23.7882679 127.155161,23.7882679 C125.348196,23.7882679 123.871946,24.7577321 123.871946,26.5425536 C123.871946,27.908625 124.687304,28.7680893 126.692304,29.4730893 L127.705875,29.8257679 C129.204268,30.3545179 129.887304,30.6409464 129.887304,31.5884464 C129.887304,32.9545179 128.697482,33.5495179 127.441589,33.5495179 C126.119446,33.5495179 124.951589,32.998625 124.092304,32.2054107' id='Fill-20' fill='%23000000'%3E%3C/path%3E %3Cpath d='M122.087143,33.858 L121.77875,32.9324643 C121.161786,33.3071071 120.544821,33.4833571 119.817679,33.4833571 C118.781964,33.4833571 118.297143,32.8663929 118.297143,31.7426429 L118.297143,24.9340714 L121.999107,24.9340714 L121.999107,23.85425 L118.297143,23.85425 L118.297143,20.2187143 L117.129464,20.2187143 L117.129464,31.7647857 C117.129464,33.5055 117.98875,34.5631786 119.751429,34.5631786 C120.610893,34.5631786 121.381964,34.3206786 122.087143,33.858' id='Fill-22' fill='%23000000'%3E%3C/path%3E %3Cpath d='M111.312696,34.4529286 L111.312696,28.2172143 C111.555018,25.8815 113.516089,24.7357857 115.499304,25.0000714 L115.499304,23.81025 C113.736446,23.5457857 112.105911,24.4272143 111.312696,25.9697143 L111.290732,23.8763214 L110.166982,23.8763214 L110.166982,34.4529286 L111.312696,34.4529286 Z' id='Fill-24' fill='%23000000'%3E%3C/path%3E %3Cpath d='M103.027732,33.4173036 C100.692018,33.4173036 98.7971964,31.5003393 98.7971964,29.164625 C98.7971964,26.8289107 100.692018,24.9119464 103.027732,24.9119464 C105.385411,24.9119464 107.280411,26.8289107 107.280411,29.164625 C107.280411,31.5003393 105.385411,33.4173036 103.027732,33.4173036 M103.027732,23.7662321 C100.053089,23.7662321 97.6513036,26.1899821 97.6513036,29.164625 C97.6513036,32.1392679 100.053089,34.5630179 103.027732,34.5630179 C106.002375,34.5630179 108.426125,32.1392679 108.426125,29.164625 C108.426125,26.1899821 106.002375,23.7662321 103.027732,23.7662321' id='Fill-26' fill='%23000000'%3E%3C/path%3E %3Cpath d='M90.8210536,33.4173036 C88.5069464,33.4173036 86.6344464,31.5003393 86.6344464,29.164625 C86.6344464,26.8289107 88.5069464,24.9119464 90.8210536,24.9119464 C93.134625,24.9119464 95.0076607,26.8289107 95.0076607,29.164625 C95.0076607,31.5003393 93.134625,33.4173036 90.8210536,33.4173036 M90.8210536,23.7662321 C89.0581964,23.7662321 87.515875,24.7356964 86.6344464,26.2119464 L86.6344464,23.8764107 L85.4887321,23.8764107 L85.4887321,38.749625 L86.6344464,38.749625 L86.6344464,32.0951607 C87.5378393,33.5935536 89.1023036,34.5630179 90.887125,34.5630179 C93.7737321,34.5630179 96.1530179,32.1392679 96.1530179,29.164625 C96.1530179,26.1899821 93.7515893,23.7662321 90.8210536,23.7662321' id='Fill-28' fill='%23000000'%3E%3C/path%3E %3Cpath d='M75.0222857,28.3934286 C75.3308571,26.2561071 76.93925,24.8237857 78.8783571,24.8237857 C80.8172857,24.8237857 82.4258571,26.2561071 82.5581786,28.3934286 L75.0222857,28.3934286 Z M83.748,28.7018214 C83.748,25.7493214 81.5885357,23.7661071 78.9003214,23.7661071 C76.1460357,23.7661071 73.8324643,25.9475357 73.8324643,29.1205714 C73.8324643,32.2495 76.2562143,34.5630714 79.0987143,34.5630714 C80.7953214,34.5630714 82.2496071,33.8580714 83.2631786,32.5578929 L82.448,31.8748571 C81.67675,32.9325357 80.5088929,33.4834286 79.0987143,33.4834286 C76.9172857,33.4834286 75.1544286,31.7868214 75.0003214,29.4511071 L83.748,29.4511071 L83.748,28.7018214 Z' id='Fill-30' fill='%23000000'%3E%3C/path%3E %3Cpath d='M64.2033571,26.9611964 L64.2033571,20.1745893 L68.1255,20.1745893 C70.54925,20.1745893 71.9594286,21.5406607 71.9594286,23.5678036 C71.9594286,25.3747679 70.7255,26.9611964 68.0813929,26.9611964 L64.2033571,26.9611964 Z M69.073,28.0408393 C71.673,27.6442321 73.1933571,25.771375 73.1933571,23.5678036 C73.1933571,20.9458393 71.4087143,19.0286964 68.1474643,19.0286964 L62.9913929,19.0286964 L62.9913929,34.4529821 L64.2033571,34.4529821 L64.2033571,28.1069107 L67.6406786,28.1069107 L72.0035357,34.4529821 L73.4799643,34.4529821 L69.073,28.0408393 Z' id='Fill-32' fill='%23000000'%3E%3C/path%3E %3C/g%3E %3C/g%3E %3C/g%3E %3C/svg%3E)

How to Make Sense of Your (Dozens of) Credit Scores

There’s your basic score, but there are plenty of others that you don’t know about and will never see

By Penelope Wang

Back in April, Lanette Andrew needed money to buy equipment for her horse farm in Sherwood, Ore. But she realized she needed to improve her credit score before she applied for a loan.

Like many Americans, Andrew, 54, has seen her income drop during the COVID-19 pandemic. After she missed some bill payments, her score fell from the mid-600s, which is considered barely adequate for getting a loan, to the 590 range, which puts affordable loans out of reach.

To get back on track, Andrew focused on paying down her balances. And she signed up for a credit score monitoring service from the credit bureau Experian, which also gave her scores from Equifax and TransUnion, the other two major credit bureaus. (Cost: $24.99 a month.)

But she discovered that the score information was a bewildering jumble of numbers—with six from Experian alone—that differed by as much as 100 points. The other two credit agencies also provided multiple scores, none of which were the same.

“It’s not at all clear to me why these credit scores are so different, and what I can do to improve them—it’s really frustrating,” says Andrew, who hasn’t applied for a loan because one of her scores is still too low.

Your Money Matters

News & advice from CR experts in our FREE Money newsletter.

Sign Up

The Complexity of Credit Scores

Andrew's confusion over credit scores is shared by millions of Americans. Though most consumers are familiar with their primary three-digit credit score, almost 40 percent don’t know they have more than one score, according to a 2019 survey by the Consumer Federation of America.

MORE ON CREDIT SCORES

How to Protect Your Credit Score During the Coronavirus Pandemic

Secrets to Credit Score Success

How to Get the Best Car-Loan Rate Despite a Low Credit Score

What the Changes in FICO Credit Scoring Mean for You

Why It's Still So Hard to Fix Credit Report Errors

Why so many credit scores? And why are they so confusing? The reasons have a lot to do with the nature of the credit business--including the fact that the three credit reporting agencies work for your creditors, not you.

"The credit scoring industry’s priorities lie with satisfying their customers, which are the lenders, while the consumer’s data is their product,” says Syed Ejaz, a financial policy analyst at Consumer Reports.

Businesses pay Equifax, Experian, and TransUnion to provide them with your credit scores—based on your credit history—to decide whether you're a good credit risk. But a bank uses different criteria than a landlord or utility to determine whether it wants you as a customer. So the credit reporting agencies tailor the information—and your credit scores—to the demands of each business.

That’s why you have dozens of different credit scores, many of which you don't know about. Your primary credit score is still used in most cases, but businesses often use several credit scores to determine your creditworthiness. The problem is you may never really know.

“When you add up all the brands and customized versions, each consumer may have more than a hundred different scores, and most of them you may never see or even know about,” says John Ulzheimer, a credit expert who has worked at FICO and Equifax.

The business priorities of the credit industry leave consumers vulnerable to financial harm, advocates say. Because Americans lack full understanding of their credit scores, they’re at a major disadvantage when applying for mortgages or other types of loans.

The credit reporting companies also use credit score data as a marketing hook, barraging consumers with TV ads and email come-ons for credit score updates and credit monitoring programs. That leaves many consumers paying subscription fees for access to a score that may be of dubious value.

Adding to the confusion, the credit industry is marketing new services designed to help you improve your scores. But those programs, such as Experian Boost, may not increase the score you actually need for a particular loan or service.

“There are many other steps consumers should take before signing up for a credit improvement program, such as paying off debts in collection and lowering your use of credit,” says Consumer Reports’ Ejaz.

There are, in fact, several strategies to help you keep tabs on important credit scores as well as improve them, as we explain below.

What Goes Into Your Credit Score

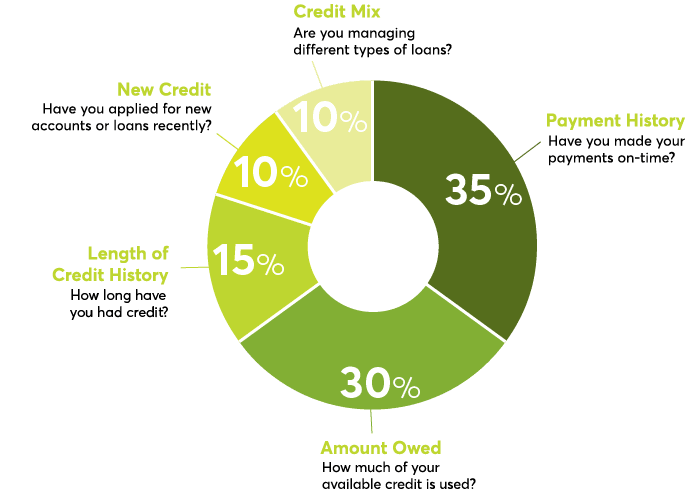

Breakdown of a FICO 8 Score

Source: FICO

How Credit Scores Work

To get a clearer understanding of the credit score system, here’s a quick recap of the basics.

Your primary credit score—the three-digit number that indicates your level of creditworthiness—is based solely on the information in your credit report, which is put together by the three credit agencies. That data includes your record for paying bills on time, the size of your credit lines, and the amount you owe in loans, among other items. (For more on understanding your credit record, see “How to Read Your Credit Report.”)

Under the federal law known as the Fair Credit Reporting Act, consumers can dispute errors and inaccurate information on their credit files. Mistakes can happen frequently, as studies have shown.

But unlike credit reports, there is no federal right to free credit scores, says Chi Chi Wu, staff attorney at the nonprofit National Consumer Law Center. There is an exception: The lender must share the credit score it used if you are turned down for credit or charged a higher rate.

The credit industry generally offers consumers limited insight into the formulas used to determine their creditworthiness or the number or type of scores that determine their access to products and services.

“The scoring algorithms are black boxes, and consumers lack information about what they can do to improve their scores,” says Marvin Owens, senior director for economic programs at the NAACP.

Credit scores can also reinforce the financial hurdles faced by those with low incomes, particularly Black consumers and other consumers of color, says Owens. Although the scores themselves are based strictly on the credit reports, some long-standing financial practices—such as charging higher auto loan rates or restricting mortgage lending to populations in certain neighborhoods—tend to disproportionately hurt the credit scores of Blacks and Hispanics, studies have found.

FICO, also known as Fair Isaac Corp., provides the algorithm, or mathematical formula, that credit reporting agencies use to calculate your credit scores. FICO 8 remains the most commonly used score, and it’s the one you often see pop up on your bank or credit card online account. (You can see a breakdown of the FICO 8 formula in the chart above.) But FICO 8 is only one of 28 scores that FICO discloses, according to Tom Quinn, vice president of myFICO.

VantageScore, a joint venture formed by the three major credit bureaus, is also used by many lenders, sometimes in addition to your FICO score. You can often find your VantageScore available for free through financial services or credit score websites.

Focusing On the Scores That Matter

Given these various brands and scoring formulas, it’s unlikely that a consumer will ever see the exact same score that the lender is using to make a credit decision.

“Even if you both are looking at the same formula and brand, your credit data is likely to vary from day to day, producing a different score,” says Rod Griffin, senior director of consumer education and advocacy at Experian.

Some of the biggest differences may crop up when comparing your base FICO 8 score to a FICO mortgage score. Mortgage lenders use older FICO formulas, which are required for mortgages sold to Fannie Mae and Freddie Mac, the government-sponsored entities that purchase most residential home mortgage loans.

These older FICO scores used in mortgage lending will weigh some factors more heavily or lightly than the newer scores. For example, if you have debt collection accounts with zero balances, they won’t be counted by more recent scoring formulas. But under the mortgage score formulas, they will be considered, says Ulzheimer.

When it comes to credit card or auto loan scores, the FICO formulas are adjusted for factors designed to be more predictive for risk in those transactions. Your history of repaying previous auto loans counts in your auto score, while bankcard scores focus on credit card accounts. (More on the key credit scores can be found in the chart below.)

You probably won’t be able to find out in advance which bureau lenders will tap for your credit score. Many lenders also employ customized formulas when making their credit decisions. But for mortgages, it’s more straightforward—lenders will pull your FICO score for mortgage lending from all three bureaus, which are included in a single document called a tri-merge credit report.

Consumers can get access to 28 FICO credit scores, including those from the major credit bureaus and auto and bankcard industry specific scores, at myFICO.com, FICO’s consumer website. (Cost: $19.95 a month and up.)

If you’re in the market for a loan, seeing these scores could be helpful as a rough gauge of creditworthiness. But for most consumers, it’s not necessary to monitor all your available credit scores.

“You can probably get a good general idea of your credit status just by looking at your base score,” Griffin says.

Key Credit Scores

TYPE OF LOAN

TYPE OF SCORE

WHERE TO FIND IT

General

Credit

FICO 8, 9

VantageScore 3.0

Free through many banks, credit card issuers, and websites

Mortgage

FICO 2, 4, and 5

Free in mortgage documents or for a fee at myFICO.com

Auto

Loan

FICO Auto

Score 2, 4, 5, 8

For a fee at myFICO.com

Credit

Card

FICO Bankcard

Score 2, 3, 4, 5, 8

For a fee at myFICO.com

Note: FICO recently released FICO 10 and 10 T versions. VantageScore has released a 4.0 version.

Credit Score Improvement Programs

For consumers with thin or subprime credit histories, new options are cropping up that claim to help you improve your scores.

Experian Boost is a free service that counts your utility payments toward your Experian FICO Score. You give Experian read-only permission to connect your bank account or credit card, and see the eligible utility and telecom accounts you select to then add your phone, utility, and streaming services payments to your billing history.

Experian Boost includes only your on-time payments. You can turn off the service at any time.

UltraFICO—a new credit score—is still in the pilot phase. (You can sign up to be alerted when it rolls out.) In addition to traditional credit bureau data, this score also looks at your banking history to determine how well you manage your money, using measures such as the amount you keep in savings and whether you bounce checks. Consumers can determine which alternative data to include.

One new service, eCredable Lift, allows you to add utility and phone payments to your TransUnion credit report. (Cost: $24.95 a year.) Unlike Experian Boost, eCredable Lift reports both positive and negative data. This means the participant needs to stay current on their payments to benefit their score. Late payments will harm their score.

“Lenders are more likely to consider payments reported by eCredable Lift due to the completeness of the reporting, even though it requires the participant to opt-in to share these accounts,” says Steve Ely, CEO of eCredable.

You should also expect only modest gains to your score—Experian Boost customers see 13-point increases on average, according to Griffin. For some consumers, however, that could be enough to move you into a higher credit score level.

While these programs could be helpful, be aware that you will be giving up personal information to the credit bureaus, says Wu of the National Consumer Law Center.

You also need to realize that the scores that could be improved may not be the same scores considered by your particular lender, who may use a different scoring formula or pull your credit history from a different bureau. Because of the requirement to use older scoring formulas, mortgage lenders will not consider scores from these programs, Ulzheimer says.

Some consumers have also had difficulty connecting their bank or utility payments to these programs. Oregon horse farm owner Andrew has struggled for several months to get her cell phone and utility payments counted by Experian Boost.

“Two customer reps promised back in April that the payments will be processed, but it hasn’t happened,” Andrew says.

Experian spokesperson Sandra Bernardo responds that the balance on Andrew’s Experian credit report was from “the most refreshed report.” But Andrew remains dissatisfied.

How to Improve Your Credit Score

Although there’s no quick fix to a poor credit score, taking these basic steps can help improve those numbers over time.

Check your credit report. This report is the foundation of your score, so make sure the information is accurate. Normally you can get one free credit report from a different reporting agency each year, which you can space out every four months to ensure regular updates. But because of the pandemic, you can request weekly reports from all three agencies through April 2021. Still, most people need to look at their reports just once a year, Wu says.

It’s best to go to AnnualCreditReport.com when requesting your report, says Leonard Bennett, a consumer litigation attorney in Newport News, Va. If you instead request your report from one of the major credit bureaus, you may be subject to forced arbitration, which could limit your ability to take legal action in the event of problems or errors in your files, Bennett says.

Dispute any errors. If you spot a problem, such as an incorrect address or unrecorded bill payment, file a dispute promptly. You can do this online, but consider mailing in the form, with return receipt requested, to have a record of the dispute, says Wu.

You may need to be persistent. By law, the credit agencies are supposed to have 30 days to respond, but the Consumer Financial Protection Bureau has said it will not enforce (pdf) that deadline during the pandemic because of staffing challenges at the credit bureaus.

Consumer advocates recently urged the CFPB to enforce the deadline, noting that consumer complaints about delays in resolving disputes have soared in recent months. But so far the CFPB has not changed its policy. The CFPB did not respond to a request for comment.

Stay on top of your finances. Two steps alone—making timely payments and minimizing your use of credit—will go a long way toward improving your credit score. Those two factors alone account for 65 percent of the FICO 8 score, says Ted Rossman, industry analyst at CreditCards.com.

If you’re having trouble managing your debts, consider getting help from a nonprofit credit counseling agency. You can find one at the National Foundation for Credit Counseling.

Plan ahead if you’re borrowing. If you’re looking to take out a loan, be careful to avoid moves that could hurt your credit score. Applying for a new credit card, for example, could result in a hard inquiry on your credit report, which is likely to ding your score.

It also makes sense to avoid closing credit card accounts. That would reduce your available credit, thereby raising your utilization rate, another factor that could hurt your score, says Rossman.

Once you’ve secured your loan, you can feel free to reshuffle your accounts. With good credit management, your score will eventually rebound.

Penelope Wang

I cover everything from retirement planning to taxes to college saving. My goal is to help people improve their finances, so they have less stress and more freedom. What I enjoy: walks through the city, time with family, and reading mysteries, though I rarely guess who did it. Follow me on Twitter (@PennyWriter).